|

MMRD BULLETIN |

|

July 27, 2024

|

|

Nikkei Myanmar Manufacturing PMI™

Embargoed until 0700 MMT (0030 UTC) 1 April 2020

Key findings:

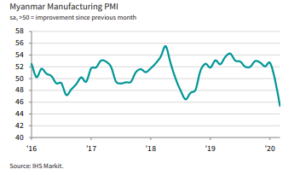

▪ PMI falls to 45.3, lowest since survey began in December 2015

▪ Record contractions in output, new orders and inventories

▪ Suppliers’ delivery times lengthen most on record

Manufacturers in Myanmar experienced their worst month on record in March as the worldwide coronavirus outbreak impacted output, demand and purchasing, according to PMI™ survey data from IHS Markit. Many survey indicators hit record lows, including output, new orders, suppliers’ delivery times and manufacturing inventories. The 12-month outlook deteriorated markedly, with overall confidence regarding future output the weakest since February 2019.

The headline IHS Markit Myanmar Manufacturing PMI is a composite single-figure indicator of manufacturing performance. It is derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases. Any figure greater than 50.0 indicates overall improvement of the sector.

The PMI posted 45.3 in February, a record low and down sharply from February’s 49.8. The latest figure signalled a marked decline in manufacturing business conditions in Myanmar, following a stagnation in February that ended a survey-record 15-month period of continuous improvement. The 4.5-point month-on-month fall in the headline figure was the largest observed by the survey since it began in December 2015. The previous low in the PMI, 46.4, was set in August 2018.

Four of the headline figure’s five components posted record lows in March – output, new orders, stocks of purchases and suppliers’ delivery times – and the fifth, employment, was the second-lowest on record. Longer supplier delivery times reflected shutdowns at Chinese suppliers, but this actually softened the fall in the headline PMI as supply chain delays are usually associated with rising demand, so the index is inverted in the PMI calculation.

The volume of new orders received by goods producers in Myanmar fell rapidly in March, following 16 consecutive months of growth. The rate of contraction was the fastest in over four years’ of data collection for the survey, easily outpacing the previous record drop in August 2018. Firms widely linked lower demand to the coronavirus outbreak.

The sharp drop in new work heavily impacted production in March, with a record contraction registered. Previously, output had risen every month since November 2018. Meanwhile, backlogs of work fell at one of the fastest rates on record. With output falling markedly, firms’ inventories of final goods declined at the sharpest rate on record.

Manufacturing employment in Myanmar fell in March as firms reacted to markedly lower levels of both new and outstanding business. The rate of job shedding was modest overall, but only slightly slower than the survey record pace set in August 2018.

The volume of new inputs ordered by manufacturers declined at the fastest pace in 17 months in March, leading to a record drop in stocks of raw materials and other production inputs. Lower demand for inputs led to the first reduction in input prices in the survey history. This, combined with a marked drop in demand, led manufacturers to cut their own prices at a series-record pace.

The 12-month outlook for production darkened in March, reflecting firms’ concerns around the economic fallout from the coronavirus outbreak. The Future Output Index registered its lowest level since the series began in December 2015.

Comment:

Commenting on the latest survey results, Trevor Balchin, Economics Director at IHS Markit, said:

“Myanmar’s manufacturers felt the impact of the coronavirus outbreak in March as the PMI fell to an all-time low of 45.3, indicative of a marked deterioration in the sector’s overall health. And the headline figure was artificially inflated somewhat by a record deterioration in supplier performance, linked to shutdowns in China. Under normal market conditions, longer input delivery times would be associated with rising demand and therefore have a positive influence on the Manufacturing PMI calculation.

“The indices for output, new orders, backlogs and purchasing activity are all signalling rapid rates of decline, though employment has so far seen only a moderate reduction. With the global economic outlook extremely uncertain, the Future Output Index dropped to the lowest on record.”

Sources: Nikkei, IHS Markit (March, 2020)

4905total visits,1visits today

4905total visits,1visits today