Myanmar Apex Bank (MAB) will provide a total of K57 billion in loans to local Small and Medium Enterprises (SMEs). The bank will provide the loans through five microfinance companies, namely Fullerton Finance (Myanmar), Proximity Finance, Vision Fund Myanmar, Early Dawn Microfinance and Pact Global Microfinance, said U Kyaw Ni Khin, CBO of MAB Bank.

Myanmar Apex Bank (MAB) will provide a total of K57 billion in loans to local Small and Medium Enterprises (SMEs). The bank will provide the loans through five microfinance companies, namely Fullerton Finance (Myanmar), Proximity Finance, Vision Fund Myanmar, Early Dawn Microfinance and Pact Global Microfinance, said U Kyaw Ni Khin, CBO of MAB Bank.

The five microfinance companies and MAB signed the agreement at MAB’s headquarters on October 30, 2019. To obtain approval from the related ministry, the bank has prepared details about rates and methods of providing and collecting loans. There are over a dozen of microfinance companies that work with MAB.

MAB has also proposed a plan to provide K5-10 billion in loans through other micro financing institutions, but has yet to receive approval from the government. In addition to these loans, MAB is also providing loans to SMEs using Germany’s Development Bank aid and JICA’s two-step loans, in which JICA lends money to banks, who provide loans to SMEs using JICA’s loan.

Source: Myanmar Business Today

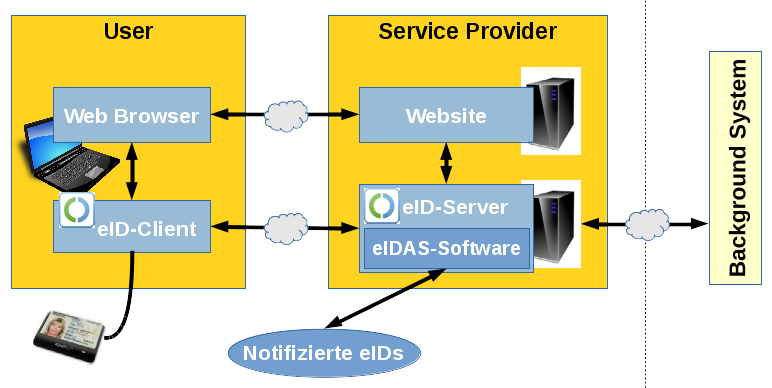

The e-ID System Working Committee held their fourth coordination meeting at the Ministry of Labour, Immigration and Population yesterday. The main, and finishing topic left for discussion is the matter of payment transactions. OeSD, the implementing Austria-based company, has sent their proposal and DACU has sent their suggestions while the Ministry of Planning and Finance is coordinating on them both.

The e-ID System Working Committee held their fourth coordination meeting at the Ministry of Labour, Immigration and Population yesterday. The main, and finishing topic left for discussion is the matter of payment transactions. OeSD, the implementing Austria-based company, has sent their proposal and DACU has sent their suggestions while the Ministry of Planning and Finance is coordinating on them both. Singapore – Myanmar-focused Yoma Strategic Holdings is planning to form a strategic partnership with AC Energy, the energy platform of Philippine conglomerate Ayala Corporation. The two companies are looking to establish a 50:50 joint venture (JV) to scale up Yoma Micro Power (S) Pte Ltd (YMP) and to explore developing around 200 megawatts of additional renewable energy projects within Myanmar, which will include participating in large utility-scale renewable projects.

Singapore – Myanmar-focused Yoma Strategic Holdings is planning to form a strategic partnership with AC Energy, the energy platform of Philippine conglomerate Ayala Corporation. The two companies are looking to establish a 50:50 joint venture (JV) to scale up Yoma Micro Power (S) Pte Ltd (YMP) and to explore developing around 200 megawatts of additional renewable energy projects within Myanmar, which will include participating in large utility-scale renewable projects. Yangonites will be able to pay Yangon City Development Committee’s (YCDC) taxes by mobile phone from 1 October. The mobile payment system for taxes was launched at a ceremony held on 12 September at the Yangon City Hall. The system was introduced with the aim of facilitating the payment of YCDC taxes, such as the municipal land tax, property tax, general tax, and kitchen and sewage tax through a mobile application wallet.

Yangonites will be able to pay Yangon City Development Committee’s (YCDC) taxes by mobile phone from 1 October. The mobile payment system for taxes was launched at a ceremony held on 12 September at the Yangon City Hall. The system was introduced with the aim of facilitating the payment of YCDC taxes, such as the municipal land tax, property tax, general tax, and kitchen and sewage tax through a mobile application wallet. The Digital Yangon App, implemented by the Digital Economy Development Committee, connects the public with the government, MPs and departments to handle issues facing the city. It can now be used in six downtown areas of Yangon. It is an application to connect the people with the local council, regional assembly, and government as part of an e-government system.

The Digital Yangon App, implemented by the Digital Economy Development Committee, connects the public with the government, MPs and departments to handle issues facing the city. It can now be used in six downtown areas of Yangon. It is an application to connect the people with the local council, regional assembly, and government as part of an e-government system. Amid the ongoing liberalization of Myanmar’s financial sector, the Central Bank of Myanmar (CBM) has hired a German consulting firm, Roland Berger Company Limited, to provide advisory services on the process of awarding licenses to foreign banks looking to do business here.

Amid the ongoing liberalization of Myanmar’s financial sector, the Central Bank of Myanmar (CBM) has hired a German consulting firm, Roland Berger Company Limited, to provide advisory services on the process of awarding licenses to foreign banks looking to do business here. Thai Life Insurance has struck a deal to take a 35% stake in Citizen Business Insurance (CB Insurance), becoming the first ASEAN insurer to enter Myanmar’s insurance field. Penetrating Myanmar’s insurance market aligns with the company’s strategy to expand operations to other countries in ASEAN, said Chai Chaiyawan, president of Thai Life Insurance.

Thai Life Insurance has struck a deal to take a 35% stake in Citizen Business Insurance (CB Insurance), becoming the first ASEAN insurer to enter Myanmar’s insurance field. Penetrating Myanmar’s insurance market aligns with the company’s strategy to expand operations to other countries in ASEAN, said Chai Chaiyawan, president of Thai Life Insurance. Myanmar has approved six joint ventures between local insurers and five companies from Japan and one from Thailand as the government moves to attract foreign investments and grow the country’s under-penetrated insurance industry, according to an announcement of the Ministry of Planning and Finance.

Myanmar has approved six joint ventures between local insurers and five companies from Japan and one from Thailand as the government moves to attract foreign investments and grow the country’s under-penetrated insurance industry, according to an announcement of the Ministry of Planning and Finance. Telecom International Myanmar Co Ltd (MyTel), launched in June last year, can roll out 5G services next year if the spectrum license is granted. The company made a test-run of the 5G service on July 31 where a speed of 1.6 Gpbs was recorded compared to the 4G network’s 150 Mbps.

Telecom International Myanmar Co Ltd (MyTel), launched in June last year, can roll out 5G services next year if the spectrum license is granted. The company made a test-run of the 5G service on July 31 where a speed of 1.6 Gpbs was recorded compared to the 4G network’s 150 Mbps. The UK government’s development finance institution announced this week a US$30 million (45.4 billion kyats) investment in the Myanmar internet service provider Frontiir, formerly known as Myanmar Net. The British CDC Group, formerly the Commonwealth Development Corporation, said the investment will help Frontiir expand across the country to eventually bring more than 2 million people online. The CDC is fully owned by the government of the UK and operates on a mandate “to build thriving communities that provide sustainable opportunities for all citizens.”

The UK government’s development finance institution announced this week a US$30 million (45.4 billion kyats) investment in the Myanmar internet service provider Frontiir, formerly known as Myanmar Net. The British CDC Group, formerly the Commonwealth Development Corporation, said the investment will help Frontiir expand across the country to eventually bring more than 2 million people online. The CDC is fully owned by the government of the UK and operates on a mandate “to build thriving communities that provide sustainable opportunities for all citizens.”